A few months ago, I wrote a blog called “how many Australians own an investment property?”. I took a look at how many Australians owned an investment property, according to data from the ATO, as a percentage of the total population of Australia. You can read the original blog here.

A very switched on reader (quick shout out to Darren Jones) pointed out that analysing the numbers in this fashion would include people who don’t submit a tax return (e.g. children). So, I decided to write another blog, this time using the total number of personal tax returns filed to derive the percentage of investment property ownership.

In the last blog, I used the approximate total population of Australia (which was about 24 million) however this time around, I’ll be using the total number of people who submitted a tax return, which is 13,508,101. You should be aware that this is the total number of individual tax returns, so would exclude property owned by companies, trusts, SMSFs etc. Also, even though this is the latest information available, it is still from the 2015-2016 financial years… this is because the ATO take awhile to release information.

If you’d like to check out the data yourself, you can head on over to this ATO page.

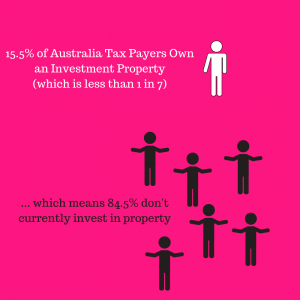

[activecampaign form=9]The ATO data shows that 2,097,392 Australian taxpayers owned an investment property in the 2015-2016 financial year. This means that 15.5% of the total amount of taxpayers who submitted a tax return own an investment property. In the original blog that looked at the total population, I revealed that 8.7% of the population owned investment property.

financial year. This means that 15.5% of the total amount of taxpayers who submitted a tax return own an investment property. In the original blog that looked at the total population, I revealed that 8.7% of the population owned investment property.

This is an increase, however still means that less than 1 out of 7 taxpayers own an investment property.

The vast majority of Australian taxpayers seem to either stop or get stuck at a single investment property. This is because 1,494,837 (or 11%) of taxpayers own a sole investment property. This is 71% of the total amount of property investors… see why I said people either stop or get stuck… almost 3 out of every four property investors have a single property.

This also equates to approximately 6.2% of the total population.

There is a sharp decline from one to two properties, with only 395,924 taxpayers owning two. This is 2.9% of the total amount of people who submitted a tax return.

This also means that 18.9% of property investors own two properties. When we consider that 71% of property investors own one property, this means that 90% of property investors have either one or two investment properties.

122,639 Australian taxpayers own three investment properties. This is 0.9% of the 13 million people who submitted a tax return, meaning that less than 1% of taxpayers have three investment properties.

The total amount of taxpayers who own four investment properties is 45,162, which is only 0.3% of the total taxpayer population. This is also 2.1% of the total amount of taxpayers who own an investment property.

It’s pretty crazy to think that less than twenty thousand (18,863 to be exact) own five investment properties. This is a measly 0.13% of taxpayers…

The number increases a little from 5 to 6+, with a total of 19,967 (or 0.14% of the taxpayer population) owning six or more properties.

While the numbers increase when you consider property ownership as a percentage of the taxpayer population when compared with the total population, the underlying theme is the same…

… less than 1 in 7 taxpayers invest in property…

… most invest in one or two properties…

… the numbers decline when considering 3 or more properties…

What are your thoughts? Are these numbers higher or lower than what you were expecting?

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Good to learn 🙂