There are 6 lenders with variable Home Loan Rates with a 2 at the beginning, according to a report from RateCity.

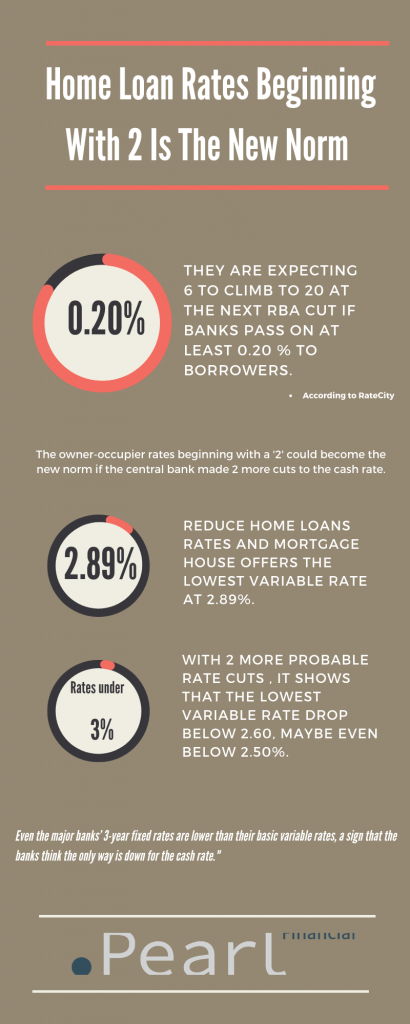

They are expecting 6 to climb to 20 at the next RBA (Reserve Bank of Australia) cut if banks pass on at least 0.20 % to borrowers.

Sally Tindall, the RateCity research director have stated that the owner-occupier rates beginning with a ‘2’ could become the new norm if the central bank made 2 more cuts to the cash rate.

“With 2 more rate cuts on the cards, we could see the lowest variable rate drop below 2.60, maybe even below 2.50%.”

From here on in, lenders are going to be hard-pressed to pass RBA cuts on in full, but rivalry in the home loan market will keep driving rates down, even if it’s not by as much as the RBA would like.”

“This pressure will force more banks to offer owner-occupier rates under 3%, especially for people with a fair amount of investment in their property.”

Reduce Home Loans Rates and Mortgage House offers the lowest variable rate at 2.89%.

In the fixed-rate section, 28 banks have already started their rates under 3%, with 77 lenders have cut down fixed Home Loan Rates in the past 2 months as banks price in future cuts.

“Some of the sharpest rates are reserved for fixed customers, starting from 2.79% for one year, and 2.94% for 5 years. Even the major banks’ 3-year fixed rates are lower than their basic variable rates, a sign that the banks think the only way is down for the cash rate.”

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.